Important Amendments in External Commercial Borrowing – Changes

notified on 14.05.2018 by Reserve Bank of India

1.

Rationalisation of all-in-cost for ECB under all tracks and Rupee

denominated bonds (RDBs)-

With a view to harmonising the extant

provisions of Foreign Currency and Rupee ECBs and RDBs, it has been decided to

stipulate a uniform all-in-cost ceiling of 450 basis points over the benchmark

rate. The benchmark rate will be 6 month USD LIBOR3 (or applicable benchmark

for respective currency) for Track I and Track II, while it will be prevailing

yield of the Government of India securities of corresponding maturity for Track

III (Rupee ECBs) and RDBs. ‘All-in-cost’-

The Meaning of “

All-in-Cost”

The term ‘All-in-Cost’ includes rate

of interest, other fees, expenses, charges, guarantee fees whether paid in

foreign currency or Indian Rupees (INR) but will not include commitment fees,

pre-payment fees / charges, withholding tax payable in INR. In the case of

fixed rate loans, the swap cost plus spread should be equivalent of the

floating rate plus the applicable spread.

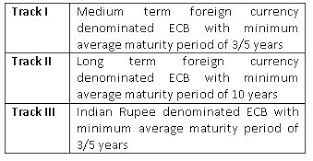

The Meaning of Tracks

under ECB

Presently, ECB can be raised under

the following TRACKS.

Track I:

|

Track II:

|

Track III:

|

Medium term

foreign currency denominated ECB with minimum average maturity of 3/5 years

|

Long term foreign

currency denominated ECB with minimum average maturity of 10 years.

|

Indian Rupee (INR)

denominated ECB with minimum average maturity of 3/5 years.

|

2. Expansion of Eligible

Borrowers’ list for the purpose of ECB –

It has been decided to permit:

Housing Finance

Companies To Avail ECB

A.

Housing Finance Companies, regulated by the National Housing Bank, as eligible

borrowers to avail of ECBs under all tracks. Such entities shall have a board

approved risk management policy and shall keep their ECB exposure hedged 100

per cent at all times for ECBs raised under Track I.

Port Trusts To Avail ECB

B. Port Trusts constituted under the Major Port Trusts

Act, 1963 or Indian Ports Act, 1908 to avail of ECBs under all tracks. Such

entities shall have a board approved risk management policy and shall keep

their ECB exposure hedged 100 per cent at all times for ECBs raised under Track

I.

Companies in Maintenance

and Freight Forwarding to Avail ECB

C. Companies engaged in the business of Maintenance,

Repair and Overhaul and freight forwarding to raise ECBs denominated in INR

only.

3. Revisiting ECB Liability to Equity Ratio provisions

–

It has been decided to increase the

ECB Liability to Equity Ratio for ECB raised from direct foreign equity holder

under the automatic route

to 7:1. This ratio will not be applicable if total of all ECBs raised by

an entity is up to USD 5 million or equivalent. Earlier an ‘ECB liability to

equity’ ratio of more than 4:1 needed approvals from the RBI.

4. ECB for Working capital purposes

5.Rationalisation of end-use

provisions for ECBs –

It has now been decided to have only

a negative list for all tracks that would include the following:

Negative list for all

tracks

Investment in Real

Estate

a. Investment in real estate or

purchase of land except when used for affordable housing as defined in

Harmonised Master List of Infrastructure Sub-sectors6 notified by Government of

India, construction and development of SEZ and industrial parks/integrated

townships

b. Investment in capital market

c. Equity investment

Additionally for Tracks I and III,

the following negative end uses will also apply except when raised from Direct and Indirect equity

holders or from a Group company, and provided the loan is for a minimum average

maturity of five years:

Additionally for Tracks I and III,

the following negative end uses will also apply except when raised from Direct

and Indirect equity holders or from a Group company, and provided the loan is

for a minimum average maturity of five years:

D. Working capital purposes

e. General corporate purposes

f. Repayment of Rupee loans

Finally, for all Tracks, the

following negative end use will also apply: g. On-lending to entities for the

above activities from (a) to (f)

Earlier, a positive end-use list is

prescribed for Track I and specified category of borrowers, while negative

end-use list is prescribed for Track II and III.