Enforcement of a foreign

arbitral award cannot be made in India if it opposes the provisions of FEMA

On 11 April 2017, the

Hon’ble High Court of Delhi (High Court), pronounced its judgment in a case

where the enforcement of a foreign arbitral award was opposed inter alia on the

ground that the enforcement of the said award would be contrary to the public

policy of India as it violated the provisions of the Foreign Exchange

Management Act, 1999 (FEMA).

Factual

Background

In 2008, Mauritius-based Cruz City 1 Mauritius

Holdings (Cruz City) entered into a Shareholders’ Agreement (SHA) dated 6 June

2008 with Cyprus-based Arsanovia Ltd. and Mauritius-based Kerrush Investments

Ltd. (Kerrush) under which Cruz City and Arsanovia Ltd. agreed to invest in

Kerrush, which in turn, agreed to invest in a real estate project captioned as

‘Santacruz Project’ in India. On the same date, Cruz City also entered into a

Keepwell Agreement with India-based Unitech Limited (Unitech) and

Mauritius-based Burley Holdings Ltd.

|

(Burley), a wholly

owned subsidiary of Unitech. Unitech and Burley, although not parties to the

SHA, signed the SHA for confirmation of certain obligations accepted by them.

Under Clause 3.9.2 of the SHA, Cruz City was entitled to exercise a ‘put

option’ to call upon Arsanovia and Burley, to purchase all equity shares of

Kerrush held by it, at the purchase price that yield a post tax IRR of 15% on

the capital contribution made by Cruz City (Put Option).

Owing to delays in

commencement of the construction of the Santa Cruz Project beyond a specified

period, Cruz City exercised the put option under the SHA. However, the put

option was not honoured and accordingly, Cruz City moved the London Court of

International Tribunal (LCIA) under the SHA as well as Keepwell Agreement.

The LCIA Tribunal

passed an award in favour of Cruz City and inter alia directed Unitech and

Burley to pay Cruz City the purchase price for the shares held by Cruz City in

Kerrush against delivery of all such shares (Award). In view thereof, a

petition for the enforcement of the said Award was filed by Cruz City before

the High Court. Main Submissions on Behalf of Unitech The enforcement of the

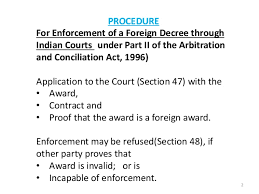

Award was opposed by Unitech inter alia on the following grounds: FEMA, being an enactment of exchange control

laws in replacement of the Foreign Exchange Regulation Act, 1973 (FERA), would

form a part of the public policy of India.

Therefore, the

enforcement of the Award would be contrary to the public policy of India in

terms of Section 48(2)(b) of the Arbitration and Conciliation Act, 1996

(Arbitration Act) as it contravened the provisions of FEMA for the following

reasons: The obligation under the Keepwell Agreement was in the nature of a

guarantee issued by Unitech on behalf of Burley, which was not permissible

under the Foreign Exchange Management (Guarantees) Regulations, 2000.

The SHA was structured

to ensure a pre-determined return on equity which was prohibited under FEMA as

it amounted to Foreign Direct Investment (FDI) on an assured return basis.

Reliance was placed on RBI circulars dated 9 January 2014 and 14 July 2014 to

contend that a foreign investor could exit the investment made in India only at

a valuation as on the date of exit. Further, as per the Foreign Exchange

Management (Permissible Capital Account Transactions) Regulations, 2000, the

shares of Kerrush could only be purchased at the fair market value of such

shares. The Award effectively directed Unitech to invest in the shares of

Kerrush, which could not be made without valuation of the shares by a

Category-I Merchant Banker/Investment Banker.

Thus, the Award was in violation of the

Foreign Exchange Management (Transfer or Issue of any Foreign Security)

Regulations, 2004. The Award in as much

as it directs Unitech to make payment against the delivery of shares of

Kerrush, in effect, directs Unitech to make an investment in Kerrush, which was

not permissible without the approval of the Reserve Bank of India (RBI). Cruz City had not claimed any relief that

Unitech purchase its shareholding in Kerrush. Consequently, no notice was

issued to Unitech either from Cruz City or the Arbitral Tribunal in respect of

any claim against Unitech.

Therefore, the Award

was beyond the relief claimed by Cruz City and without notice to Unitech and

hence, its recognition and enforcement ought to be declined in terms of

Sections 48(1)(b) and 48(1)(c) of the Arbitration Act. Main Submissions on

Behalf of Cruz City The Award did not

require Unitech to purchase the shares of Kerrush but only to pay the purchase

price in accordance with Unitech’s obligations under the Keepwell Agreement. Violation of FEMA would not amount to a

violation of public policy under Section 48(2)(b) of the Arbitration Act.

In any case, there was no violation of FEMA in

entering into the Keepwell Agreement. Further, the question whether any permissions

from the RBI were required for remitting of the money recovered from Unitech in

the enforcement of the Award, would be a question to be addressed after the

amount awarded had been recovered.

Unitech was precluded from raising any plea to

the effect that the Keepwell Agreement was illegal or that the approval of the

RBI had not been obtained since, under the Keepwell Agreement, Unitech had

expressly represented that the transactions were in compliance with all

applicable laws. Unitech was also

precluded from raising the objection that it was not given an opportunity to

present its case on the principles of res judicata since it was open for

Unitech to raise these issues before the Court in the United Kingdom (UK),

wherein it had challenged the Award or before the Arbitral Tribunal.

Decision

of the High Court, New Delhi

The High Court

rejected the objections raised by Unitech against the enforcement of the Award

and decided the issues as follows: On whether Unitech was required to purchase

the shares of Kerrush The premise that

the Award requires Unitech to purchase the shares of Kerrush is fundamentally

flawed. The Arbitral Tribunal having found that Unitech had breached its

obligations, directed it to pay the purchase price. The Award only seeks to

enforce Unitech’s obligations undertaken under the Keepwell Agreement. There is

no stipulation in the Award that the shares must be delivered only to Unitech.

Although, the Award requires Burley and Unitech to pay the purchase price, it

does not require that the delivery of shares of Kerrush be made to Unitech and

not Burley.

The payment of purchase price for the shares

of Kerrush by Unitech would be on behalf of Burley which is in conformity with

the obligations that were undertaken by Unitech in the Keepwell Agreement. On

violation of FEMA ipso jure being in conflict with Public Policy The objections to enforcement on the ground of

public policy must be such that offend the “core values of a member State's

national policy and which it cannot be expected to compromise”. A simpliciter violation of any particular

provision of FEMA cannot be considered synonymous to offending the fundamental

policy of Indian law.

The expression

“fundamental policy” must mean only the fundamental and substratal legislative

policy and not a provision of any enactment. There has been a material change in the

fundamental policy of exchange control as enacted under FERA and as now

contemplated under FEMA. The objective of FERA was to ensure that the nation

does not lose foreign exchange essential for economic survival of the nation

whereas under FEMA, the focus had shifting from prohibiting transactions to a

more permissible environment.

The enforcement of a foreign award will

invariably involve considerations relating to exchange control or remittance

outside the country for enforcement of foreign award or the initial agreement

pursuant to which award required permission of RBI. However, these concerns can

be addressed by ensuring that no funds are remitted outside India from RBI,

which addresses the issue of public interest and foreign exchange. Thus, the High Court held that the question of

declining enforcement on the ground of a simpliciter violation of any provision

of FEMA cannot be considered synonymous to offending the fundamental policy of

Indian Law but, any remittance of money recovered from Unitech in enforcement

of Award would necessarily require compliance of regulatory provision and/or

permissions.

On whether the Award

violated the provisions of FEMA The

Award does not contravene the Foreign Exchange Management (Guarantees)

Regulations, 2000 since Regulation 5 specifically permits the giving of

guarantees in certain circumstances, including by a company in India for and on

behalf of a wholly owned subsidiary. In the instant case, Burley is a wholly

owned subsidiary incorporated by Unitech in Mauritius and, therefore, it was

entitled to give guarantees for Burley’s business to stand as surety for

obligations undertaken by Burley within the limits prescribed in the Foreign

Exchange Management (Transfer or Issue of any Foreign Security) Regulations,

2004.

Unitech cannot take

the argument that Burley has no business and therefore, Regulation 5 (b) of the

Foreign Exchange Management (Guarantees) Regulations, 2000 would not be

applicable since it is not bonafide, a complete afterthought and runs contrary

to the express representations made by Unitech in the Keepwell Agreement. On

whether the SHA provided an assured return.

The Put Option was not

an open ended assured exit option and could be exercised only within a

specified time and was contingent on the Santa Cruz project not being commenced

within the prescribed period. RBI only

restricts assured return instruments brought in India under the guise of

equity. However, in the present case, Cruz City is only seeking to enforce its

obligations against Burley.

Even if it is accepted

that the Keepwell Agreement was designed to induce Cruz City to make

investments by offering assured returns, Unitech cannot escape its liability as

Cruz City had invested in Kerrush on the assurances held out by Unitech. Hence,

even if Unitech may be liable to be proceeded against for violation of

provisions of FEMA, the enforcement of the Award cannot be declined. On whether

Unitech was precluded from raising the plea that it was unable to present its

case.

The principle of res

judicata is applicable only where the issue/controversy is finally considered

and decided by a ‘court of competent jurisdiction’ and the question whether the

award will be recognised/enforced in India cannot be adjudicated by any other

forum in any country except the courts of India.

The

Learning from the Case

This judgment rendered by the High Court may

have far reaching consequences for other pending disputes on similar issues.

The High Court came down heavily on Unitech and observed that it must ‘bear the

consequences of violating the provisions of law, but cannot be permitted to

escape their liability under the Award’. The message is that parties representing

that the transaction is in compliance with all applicable laws cannot be

permitted to derogate from their obligations under the contract in the garb of

an alleged violation of a provision of law at a later stage. Further, this

again reflects the approach of the courts in India to not interfere in the

arbitral proceedings and awards.

Courtesy : Sanjeev

Kapoor (Partner), Aakash Bajaj (Senior Associate) and Aayush Jain (Associate)

of khaitan & Co

thanks for sharing currency, gold and forex signal it is very important for any currency exchanger knowledge base post.

ReplyDelete