Tata-DoCoMo

case: Delhi HC okays $1.18-billion damages, Rejects RBI's plea

FACTS

OF THE CASE

Signalling

an end to a long-drawn regulatory tussle, the Delhi High Court (HC) on Friday upheld a settlement

agreement between Tata Sons and NTT DoCoMo to realise the $1.18-billion London Court of

International Arbitration (LCIA) award in favour of the Japanese telecom

giant.

This

is a significant development as the DoCoMo settlement is learnt to have been priority for the

new Tata Sons chairman, N Chandrasekaran.

The Tata Teleservices-DoCoMo joint venture (JV) was scripted in 2008 when Ratan Tata was the chairman of the group.

Rejecting

the Reserve Bank of India (RBI) intervention in the enforcement proceedings,

Justice S Muralidhar pronounced the verdict after coming to the conclusion that

there was nothing contrary to any provision of Indian law in the February 2017

settlement plan submitted by the two companies to resolve their dispute.

“It

appears to be a well-settled legal position that parties to a suit, or as in

this case, an award, may enter into a settlement even at the stage of execution

of the decree or award,” said Justice Muralidhar in a single-Bench

judgment.

Honouring

the International Covenants

Friday’s

decision held that the issue

of an Indian company honouring its commitment under a contract with a foreign

entity would have a bearing on its goodwill and reputation in the international

arena and have an indubitable impact on strategic relationships between countries.

It

also concluded that a third party (the RBI) could not be allowed to oppose the

compromise arrived at between the two companies in such a manner.

Grounds for RBIs Objection

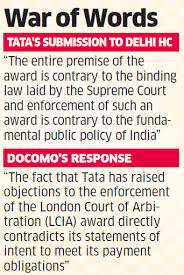

The RBI had opposed the enforcement of the LCIA award in the high court, saying it was void in law,

as it had failed to consider the existent regulatory prohibitions and would

effectively allow something that could not be done directly to be done in an

indirect manner.

According

to the RBI, the award was in violation of Regulation 9 of the Foreign Exchange

Management (Transfer or Issue of Security by a Person Resident Outside India)

Regulations, 2000 (as amended in 2013), which prohibited the transfer or sale

of shares at a price exceeding the market price of shares arrived at by any

international valuation methodology. The banking regulator had also said that

the award was in violation of Section 6 of the Foreign Exchange Management Act,

1999, which empowers the RBI to prohibit, restrict or regulate the transfer of any

security by a person outside India.

Stating

that the award had allowed a restricted capital account transaction in the garb

of a breach of contract, the RBI had claimed that the award (and the settlement

agreement) was against the fundamental policy of India and incapable of

enforcement in any circumstance. The lawyer for the RBI had also highlighted its apprehensions of the issue

becoming a dangerous precedent for similar cases in the future, if the award

was eventually enforced.

DoCoMo’s lawyer, senior advocate Kapil Sibal, had

opposed the RBI stance by highlighting that the banking regulator

could not object to civil proceedings between two private parties for the

enforcement of a valid international arbitration award. After initially opposing the

enforcement, Tata’s counsel, senior advocate Darius Khambata, had also

supported the enforcement in line with their joint settlement agreement and

said that the realisation of the award would send a strong signal for future

foreign direct investments to come into India.

However , if you go through my earlier blog posting on

the heading

“Enforcement of a foreign arbitral award cannot be made

in India if it opposes the provisions of FEMA”

The same Delhi High Court has given a different

analysis and findings.

More comments on the contradictions in the above

mentioned cases are always welcome.

nice write up Sir, Very informative

ReplyDeleteIn Forex Standard Pack we provide 80% accuracy in Forex signals. forex signals Fx Signals, foreign exchange, forex rates, currency Signals.

ReplyDeletegood news to customer fore foreign exchange market India. good thanks for sharing this post.

ReplyDelete